Follow Us

10 Street Name, City Name

Country, Zip Code

555-555-5555

myemail@mailservice.com

Should I Capitalize Interest or No

Most traditional Premium Finance programs require the client to pay full interest on the loan whereas many (but not all) of NIW’s designs capitalize on the interest. Why does NIW use a different approach? Could it be that the prevailing approach is wrong? Capitalizing interest ultimately means rolling the interest into the loan, which has advantages and disadvantages to overpaying for the interest out-of-pocket. When designed correctly, NIW finds that most of the time clients prefer the interest on financed insurance cases to be capitalized. However, the right conditions must be met because there are multiple situations when this is not possible or recommended. Paying the interest into the trust has historically been the norm for premium finance cases. However, this method comes with the price of gift taxes, opportunity costs, and fees associated with liquidating assets. The problem of paying interest out-of-pocket is circular.

Many programs rely on the cash accumulation of the life insurance policy to pay off the loan, and in order to get surplus cash accumulation the design must be over-funded. The result of over-funding is that the borrower (typically a trust) needs to continue borrowing larger sums of money to achieve the optimum level of funding. Over-funding results in a very large loan, and consequently more interest. As a result, the client ends up paying as much (or more) in interest as purchasing a conventional life insurance product. Clearly, paying interest payments out of pocket defeats one of the primary reasons clients use financing in the first place. On the other hand, if you don’t over-fund the policy you can’t create the surplus cash value to pay off the loan.

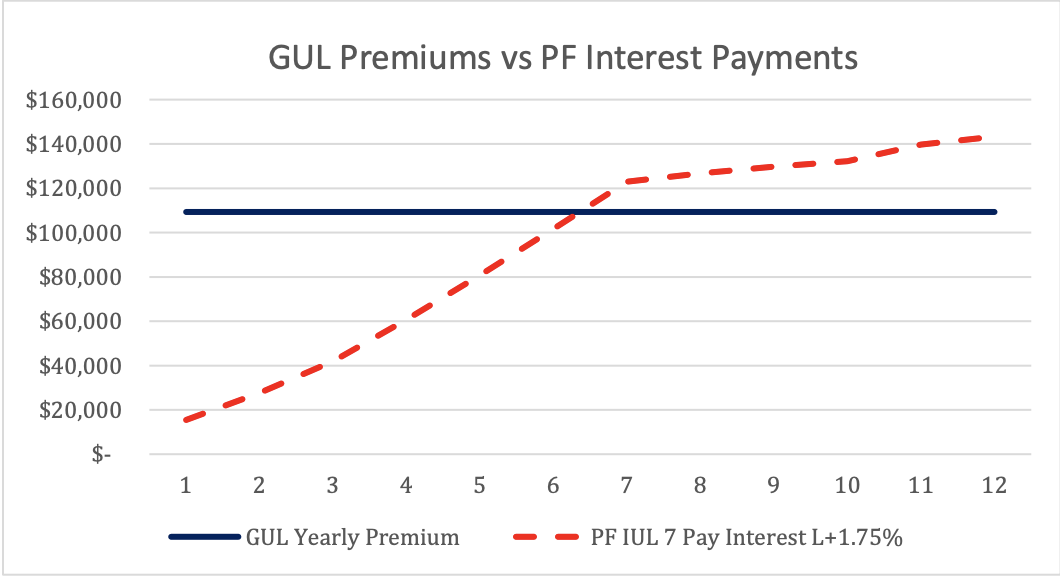

Damned if you do; damned if you don’t. The chart below shows a typical 7 pay funding pattern where the client is financing and paying full interest out of pocket. This is compared to the premium payments the client would have been making if they had purchased insurance out of pocket. The following chart compares annual payments for a $10m Policy GUL vs. interest payments on a 7 Pay PF IUL 45- year-old Male Standard Non-Smoker. The loan was priced at the current forward 30 day LIBOR curve +1.75%.

Request More Information

Get your free, no-hassle consultation

Contact Us

We will get back to you as soon as possible.

Please try again later.

Goldwater Financial Group

The information provided herein is the exclusive property of Goldwater Financial Group, LLC. This material has been prepared for

informational and educational purposes only. It is not intended to provide nor should be relied upon for accounting, legal, tax, or investment advice.